Company

Joyn Insurance

Year

2023 - 2024

Type of Work

Product strategy, design, research, and management

Joyn’s internal underwriting team was struggling to keep up with quote volume. Turnaround times from 'Ready for Underwriting' to 'Quoted' were too slow, and the existing internal tool, Spark, wasn't focused on the underwriting experience.

I was tasked with identifying friction in the underwriting process and designing features that could help speed up quoting without sacrificing accuracy.

01

Discovery

To understand the workflow, I shadowed every underwriter over the course of three months. I observed their screens as they worked on live submissions, followed by 1:1 Q&A sessions. This gave me a detailed look into the quoting process and surfaced hidden friction points that wouldn’t have come up through surveys or interviews.

02

Key Friction Points

1. No consolidated view of critical data

Spark’s layout forced users to scroll through long forms and tabs, making it hard to compare multiple locations. Many UWs resorted to Excel to make sense of the data.

2. No way to preview quotes before sending

Without a preview screen, underwriters created multiple draft quotes just to verify totals.

3. No ability to send quotes in-app

To send a quote, underwriters had to download a PDF and manually email it through Outlook.

03

Navigating Ambiguity

My project surfaced a deeper issue: underwriting at Joyn lacked consistency. Every underwriter had their own process, leading to inefficiencies and confusion. I led a cross-functional effort with Underwriting Operations to align on what good underwriting should look like and built product features that reflected that vision.

04

Requirements

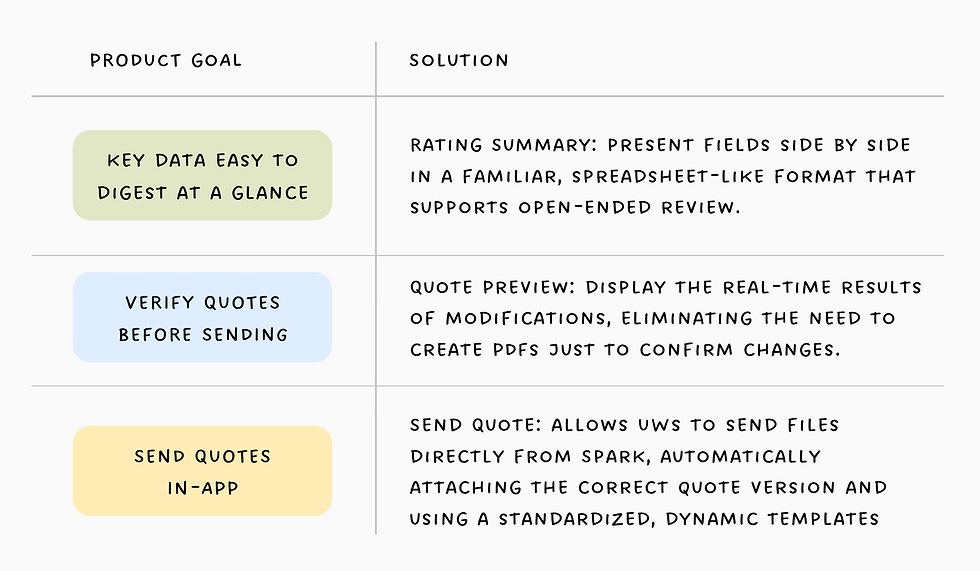

We defined three core product needs to reduce quoting time while improving accuracy and consistency.

05

Roadblocks

Underwriting wanted 'Spark Sheets', a full Excel-like editing in-app, including multi-cell updates and keyboard shortcuts. Engineering flagged major risks: our data model couldn’t support real-time edits.

To move forward, I aligned both teams around a scoped solution:

Rating Summary would offer a read-only, spreadsheet-style view, and Quote Preview would support confident final checks before sending.

This compromise preserved performance while meeting visibility needs.

06

Final Designs

Designs were finalized in collaboration with the users, then presented to the engineering team. I created tickets for the front-end team and tested the PRs in partnership with the QA team before the feature was deployed.

07

Impact

The implementation of 3 key features has significantly boosted our underwriting efficiency. As the company faced unprecedented product volume, the graphs below demonstrate that our underwriters were able to maintain a steady quoting time despite the team size remaining relatively unchanged. Even as we handled more products and generated more premium, Joyn's commitment to delivering quick quote turnarounds remained strong.

100% Increase in Quoted Products

Volume of products quoted in 2024 soared from 700 (Jan) to 1,400 (May) per month

6-7

Business Days

Launch dates of the features coincide with the consistent quoting speed (stable green line)

2X

Productivity

UWs quoted twice as much without compromising turnaround time, showing the features' scalability.

150% Increase in

Quoted Premium

Starting in 2024, we were quoting $8M monthly and jumped to nearly $20M in May, showing volume & complexity of submissions.

40%+ of Products Quoted Within 36 Hours

Underwriters were delivering quotes just as fast, meeting the company's target SLA even as premium skyrocketed.